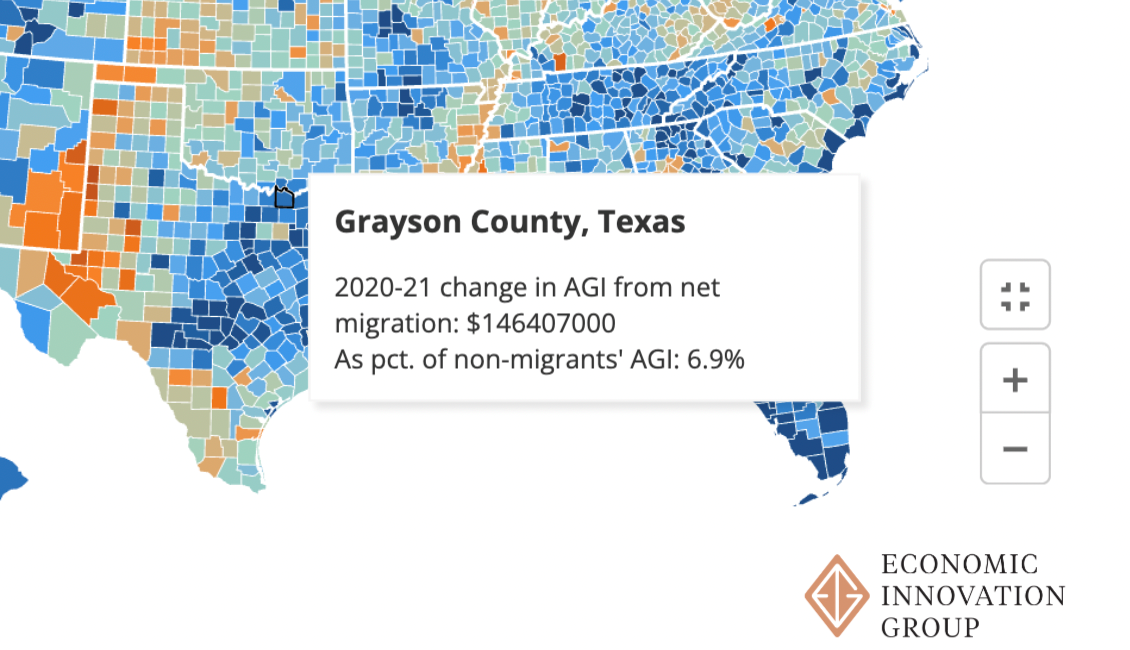

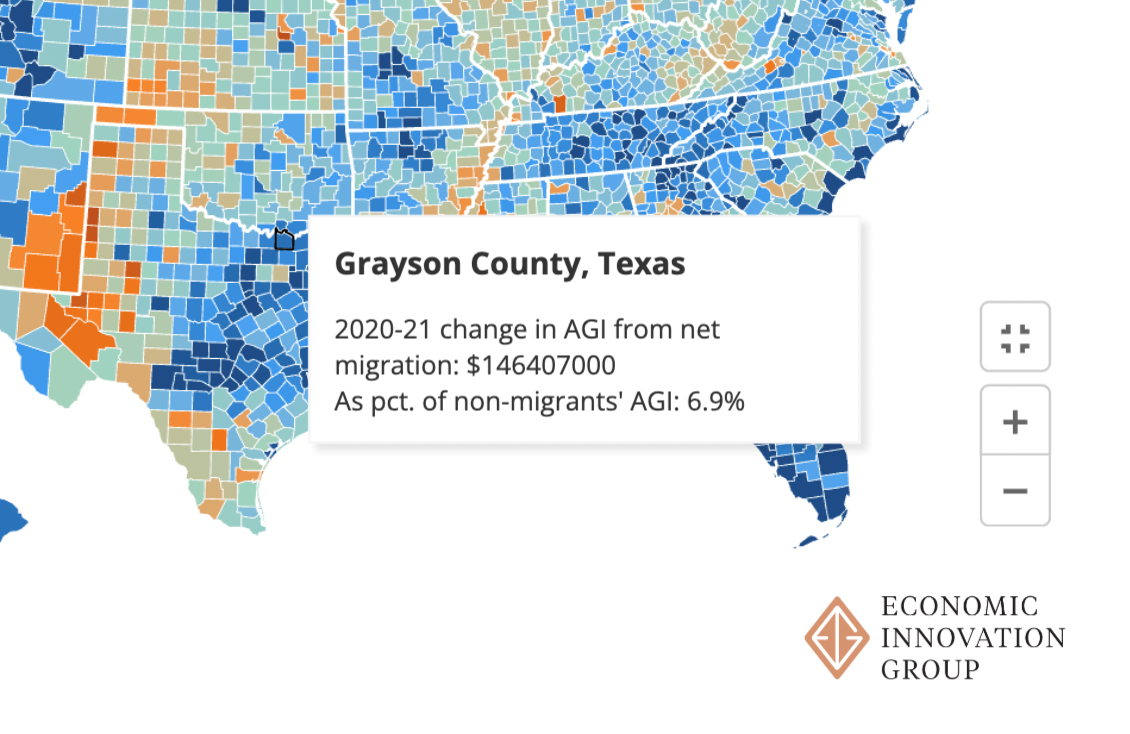

In 2020-2021 Grayson County netted 1,422 more tax payers. The average income of those that left was $56K, while the average income of those that came to Grayson County was $69K. The article below entitled “Tax Data Reveals Large Flight of High Earners from Major Cities During the Pandemic” further explains the trend:

Tax Data Reveals Large Flight of High Earners from Major Cities During the Pandemic

ANALYSIS

AUGUST 8, 2023

by Connor O’Brien

Key Findings

• The exodus of workers and families from major U.S. cities during the first two years of the pandemic was exceeded by an even larger outflow of income.

• Newly-released IRS data shows taxable income (Adjusted Gross Income, or AGI) in large urban counties fell by more than $68 billion between 2020 and 2021 from net migration alone, a dramatic acceleration of pre-pandemic leakage.

• Rural counties benefited most from the outflow of earnings from major cities; net growth in AGI from net migration totaled more than 1.5 percent of existing residents’ taxable incomes, the highest of any county type.

• Geographically, pandemic growth regions like Florida, East Texas, the Southern Triangle, and broad swathes of the Mountain West saw large inflows of income, coinciding with rapid post-pandemic population growth.

• Income flows out of urban areas and towards these growth regions appears to have been driven by upper-income households; in growing counties, in-migrants were on average higher earners than out-migrants, while in shrinking counties, out-migrants earned more than newcomers.

Introduction

Three years into the economic recovery from the shock of the Covid-19 pandemic, we are continuing to learn more about the enduring fingerprints the crisis has left on America’s economic geography. In previous work, we have covered the flight of Americans from urban areas and cities’ subsequent disappointingly-slow recovery, the prominent role that young families played in the recent urban exodus, and the new emerging map of American manufacturing in the wake of the pandemic.

Now, newly-released IRS data allows us to shed further light on the character of the urban exodus that took place in 2020 and 2021 from the perspective of income. Tracking households’ tax returns as they move from county to county, we indeed find that the flight of workers and families from major cities also entailed a major exodus of taxable income. Concurrently, suburbs and exurbs in booming metro areas across the Sun Belt saw a major inflow of relatively higher-income households, along with pockets of rural areas throughout the country. These patterns, if not reversed, may ultimately have long-lasting impacts on issues including, but not limited to, local housing markets, demand for retail in urban cores, and the fiscal sustainability of public services operated by local governments.

The pandemic sparked an outflow of income from major cities

The country’s large urban areas were hit hard by the pandemic and subsequent economic recovery on a number of fronts. Between 2020 and 2021, IRS data shows that net migration subtracted more than $68 billion from large urban counties’ aggregate taxable income. Meanwhile migration added to taxable income in all other types of counties, even smaller urban peers. The scale of decline in large urban areas was equivalent to nearly two percent of total taxable incomes in such counties. In contrast, newcomers to rural counties have added more than 1.5 percent to taxable income in each of 2020 and 2021.

Interestingly, major declines of taxable income in large urban counties in 2021 were mainly driven by a handful of the very largest coastal cities that saw, in some cases, staggering flights of income. Manhattan alone lost more than $16 billion in federally-taxable income (spread across more than 37,000 returns) through net migration, equivalent to more than 13 percent of remaining residents’ combined taxable incomes. Net migration out of San Francisco left that city’s federal income tax base more than $8 billion—or 20 percent—smaller between 2020 and 2021 alone. Boston (-$2.5 billion, -11 percent), Washington D.C. (-$1.6 billion, -7.6 percent), and Los Angeles (-$8.8 billion, -3.7 percent) were also among those large urban counties hit hardest by outmigration.

Growing places are attracting higher-earning migrants, while shrinking places are seeing a flight of higher-income households, on average

IRS data, in being limited to the raw number of returns moving between two places and the combined taxable incomes on those returns, only allows us to examine the average incomes of those leaving or staying in a particular county. Nevertheless, pandemic-era migration exhibited a clear pattern: in-migrants to places that are growing were, on average, much higher earning than out-migrants. Conversely, in those places that are outright losing households via net migration, leavers earn much more than newcomers.

In Maricopa County, Arizona, which added the most tax returns of any county via net migration (13,700), the average incoming household made more than $92,000 in 2021, while the average out-migrant household earned just under $77,000. Lee County, Florida, which added the second most, took in migrants with average taxable incomes of nearly $123,000, while those who left earned less than $75,000. This pattern held true in most of the country’s growing regions, among them the booming suburbs surrounding Austin, Dallas, Nashville, Boise, and Las Vegas and in rural parts of the country that saw pandemic-era net inflows like northern Michigan and most of northern New England.

In large cities that saw major outflows of people and income, those who left were, on average, much higher earners than those who migrated in during the pandemic. In San Francisco, the average household leaving the city earned $105,000 more than the average household moving in. Across the Upper Midwest, income differences between newcomers and leavers were smaller, but still significant. In Cook County, Illinois, incoming households earned, on average, $37,000 less than those leaving, while gaps in Cuyahoga County, Ohio ($22,000), Wayne County, Michigan ($15,000), and Hennepin County, Minnesota ($15,000) were also substantial.

Across all large urban counties, out-migrants earned nearly $10,000 more than average in-migrants. In 2019, just before the pandemic began, the gap between leavers and newcomers in large urban counties was half that amount, and in 2012 it averaged under $2,000. Rural counties, meanwhile, saw the reversal of this trend; in 2021, newcomers to rural counties made on average $11,000 more than those leaving.

Income migration patterns are another sign that the balance of the American economy is shifting further towards the Sun Belt and Mountain West

Taking stock of the set of emerging trends in population growth, major investments in manufacturing facilities, and now, income tax data from 2020 and 2021, a broad and significant shift in economic activity away from older, coastal metro areas towards newer and more sprawling regions across the Sun Belt and Mountain West has clearly accelerated in the post-pandemic era. The post-pandemic rural boomlet, too, long evident in the geographic distribution of the startup surge, has also now also been reaffirmed by large inflows of taxable income.

The ultimate drivers of these shifts, from strong job growth to new opportunities opened up to families by remote work, are at this stage still hard to untangle. Nevertheless, if these shifts hold or continue, they will have serious impacts on the country’s economic geography, leaving some regions flush with new resources and others struggling to fill eroded tax bases.

Conclusion

Tax data gives us, for the first time, a highly granular and reliable sense of the average economic characteristics of those driven to move to new counties or states over the past few years. It highlights that shifts in population also involve real shifts in financial resources, a fact relevant not only for local governments trying to balance budgets, but investors, retailers, transit planners, and other parties whose decisions rest on forecasts of future local consumer spending.

Tax Data Reveals Large Flight of High Earners from Major Cities During the Pandemic